Your cart is currently empty!

Common Size Statements: Types, Formula, Limitations & More Plutus Blog

The balance sheet is a representation of the assets of a company. There’s also a separate version of the common size balance sheet where any current asset line items are listed as a percentage of the total assets. It would work the same with liabilities listed as a percentage of total liabilities. It also includes stockholders equity being listed as a percentage of total stockholders equity. The balance sheet of a company gives an overview of shareholders’ equity, assets, and liabilities for a reporting period. A common size balance sheet analysis gets created with the same rationality as the common size income statement.

8: Common-Size Statements

Get direct access to me as well as tools for improved decisions that can lead to improved performance. Our partners cannot pay us to guarantee favorable reviews of their products or services. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

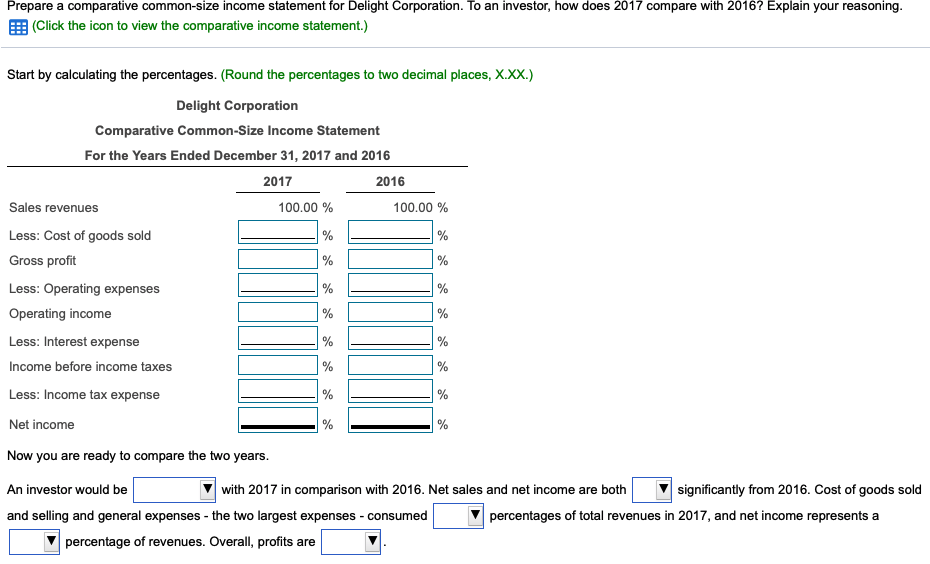

Income Statement Common Size Analysis

A common size financial statement is a specific type of statement that outlines and presents items as a percentage of a common base figure. The process of creating a common size financial statement is often referred to as a vertical analysis or a common-size analysis. When you show the items on the income statement as a percentage of the sales figure, it makes it easier to compare the income and expenses and understand the financial position of the company. Common size analysis is an excellent tool to compare companies of different sizes or to compare different years of data for the same company, as in the example below. A common size balance sheet allows for the relative percentage of each asset, liability, and equity account to be quickly analyzed. Any single asset line item is compared to the value of total assets.

- For this reason, the top line of the financial statement would list the cash account with a value of $1 million.

- Utilize accounting software and a detailed checklist to ensure accurate entries and comprehensive income tracking.

- A common size financial statement is a financial report, where all figures are presented as a percentage of the most important financial metric.

- For example, if Company A has $1,000 in cash and $5,000 in total assets, this would be presented in a separate column as 20% in a common size balance sheet.

- On the income statement, analysts can see how much of sales revenue is spent on each type of expense.

Format of Common-size Income Statement (Statement of Profit & Loss)

It’s a quick way to get an analysis of a company’s financial health. To calculate total income, subtract operating expenses from gross profit. This number is essentially the pre-tax income your business generated during the reporting period. This can also be referred to as earnings before interest and taxes (EBIT). An income statement is a financial report detailing a company’s income and expenses over a reporting period.

What is a common-size financial statement?

I still use these when deciding whether to invest in a bank’s stock or to assess their financial health before placing a deposit with them. This example is from banking, but the concepts apply to common-size analysis for most industries. This company has a high cash ratio but may have a major investment in the following year they are preparing for.

Common size cash flow statement analysis

The next few lines back us into operational cash flow, which is 14% of revenue. It says that every dollar of revenue led to 14 cents of net operational cash flow available for financing and investing activities. A common-size balance sheet is a comparative analysis of a company’s performance over a time period.

That’s followed by the provision for loan losses and realized security losses to arrive at a pre-tax net operating income as a percentage of assets. The next column shows the common-size percentages of their peer group. what is unearned revenue a definition and examples for small businesses The balance sheets of all the largest banks are totaled, and a common-size balance sheet is created from those totals. This is an example of competitor or industry analysis used for business environmental analysis.

Return on assets (ROA) and return on equity (ROE) are two common earnings ratios used to assess a company’s performance. Bank earnings are driven by their balance sheet, so ROA is used more commonly in that industry. The report above shows how much each major line of the income statement adds to or subtracts from ROA.

Rapid increases or decreases will be readily observable, such as a fast drop in reported profits during one quarter or year. By breaking down each component as a percentage of revenue, it offers a transparent view of where money is spent and earned. Automating data entry processes and conducting regular audits can help reduce manual data entry errors like duplication and omissions. It’s important to do monthly account reconciliations to maintain data integrity and ensure financial records are accurate and follow the rules. It’s worth noting that if two companies are using different accounting methods the comparisons might not be accurate. My guess is that you understand the relative importance of each line item much more quickly and effectively via this graph than the earlier vertical table of numbers.

The most frequent common size financial statements include the likes of the cash flow statement, the income statement, and the balance sheet. Essentially, it allows data entries to be listed as a percentage of a common base figure. This is instead of a traditional financial statement that would list items as absolute numerical figures. Financial statements that show only percentages and no absolute dollar amounts are common-size statements. All percentage figures in a common-size balance sheet are percentages of total assets while all the items in a common-size income statement are percentages of net sales. The use of common-size statements facilitates vertical analysis of a company’s financial statements.

Leave a Reply